Dollar Laxmi

The fall of NPR vis-à-vis USD is a bonanza for Nepal’s remittance-driven economy

During the upcoming festival of lights called Tihar in Nepal and Diwali in India, families will take the opportunity to clean up their valuables, make an inventory of their wealth and store their assets back into a safe deposit box. And explode firecrackers.

The big day of Laxmi Puja this year is on 7 November, and people worship the goddess and welcome her home in the hope that she will ensure prosperity in the coming year.

Many Nepalis invest in gold or property, and this year everyone will be happy that the value of both have gone up. If you have saved in paper money, a thousand rupee note sadly is now worth only Rs 930 in terms of purchasing power.

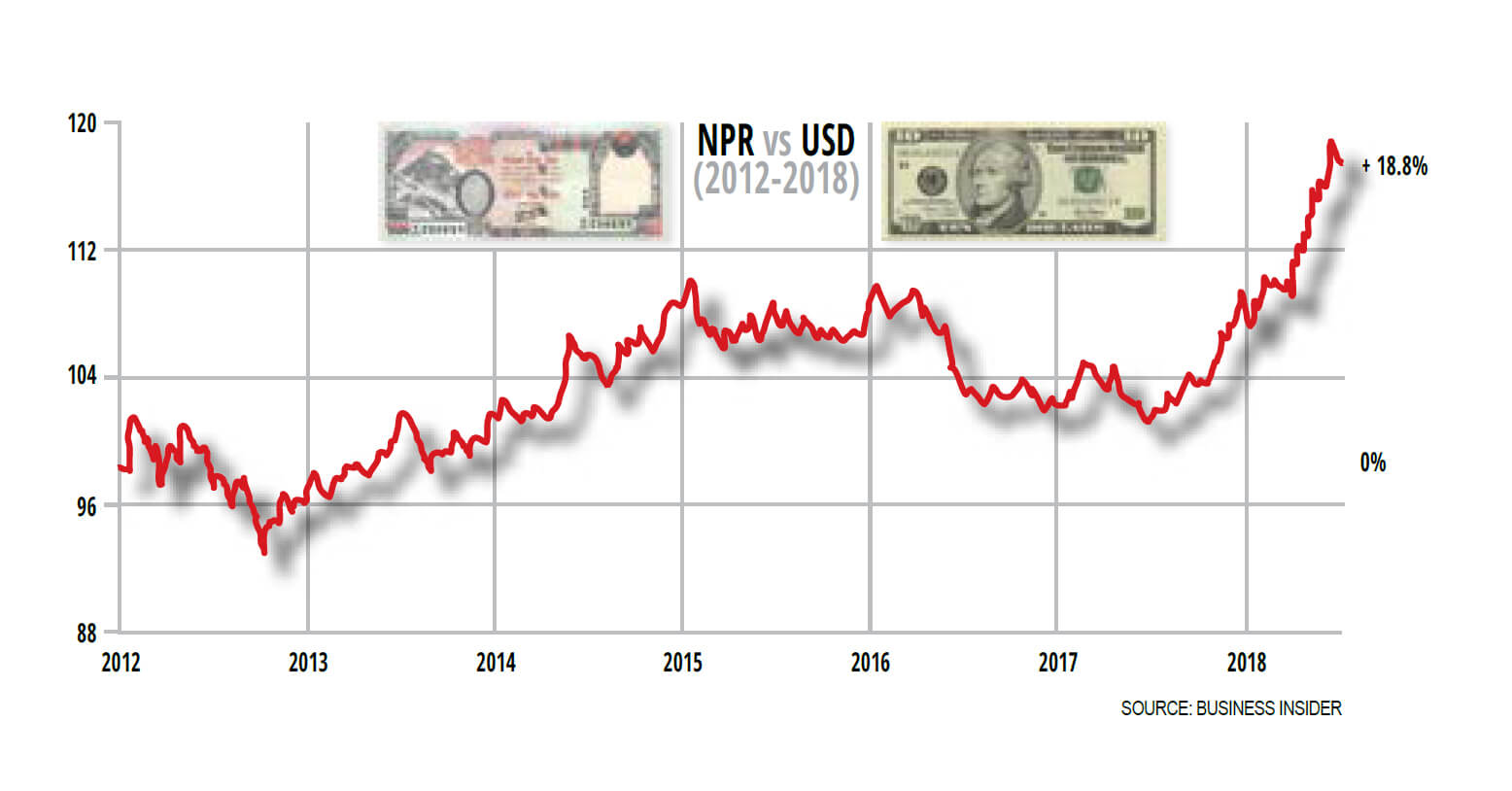

Last year, the US dollar was at Rs100 per dollar, this week it is at nearly Rs120. Economists will tell us that the Nepali rupee is pegged to the Indian currency since 1956, and hence when its value falls the Nepali rupee also falls. India needs to import a lot of oil which is getting more expensive because the United States imposed sanctions on Iran and Venezuela thus decreasing global supply.

There has also been a slowdown in India’s economic growth rate, and the US economy is doing well because American companies are bringing home profits from money invested abroad. All this is impacting Nepal via India.

There was a time when Nepalis calculated their wealth in number of elephants (Gajalaxmi), number of cows and piles of manure (Gobardhan). Today, the cost of the dollar is a concern, just as it is to buy wine, electronics, cars, or to spend holidays abroad. One in four Nepalis is living abroad, and they send home hard currency, which means the festival of Laxmi Puja will see greater spending than before. This is why despite the Nepali economy having tanked, spending power is high.

For tourists visiting Nepal, everything will seem cheaper, but hotel rooms, air tickets, tour packages are all priced in dollars and therefore should really make no difference. They are going to be irritated that entrance fees to Nepal’s conservation areas have gone up since they got on the flight to Nepal.

Ideally for those exporting goods and getting paid in US dollars, the situation is rosy, unless you have component inputs like oil, machine parts, ingredients that have US dollar price tags.

While everyone complains that everything is getting more expensive, few blame the political parties for the state of the economy. Even fewer demand the Central Bank to “do something”. Should the Nepali currency be un-pegged or should we set a new peg-rate to the Indian currency? Do we need to close the Nepal-India border before we do that? The regulators in China get accused of devaluing their currency to help exports, should Nepal use this opportunity to boost exports?

Decisions like these require sound market information which we seem to lack. We rely on tables and indices made by donors and multilateral agencies. One thing we can be sure of is that there will be a seminar on the topic of the falling rupee after Laxmi Puja. Experts will present their views and proceedings will be recorded. Bureaucrats will line up to go on foreign-funded fact-finding junkets to study the impact of currency drops.

Actually, the falling value of the Nepali currency against the US dollar is an advantage for Nepalis who depend on remittances, or for those who want to produce and export. It is a really bad deal for those who depend on imports, or those sending children off to study abroad. For those earning in dollars and spending in Nepali rupees, things could not be better. For the poor who have no money this whole discussion is a waste of time.

Anil Chitrakar is President of Siddharthinc.

writer