Sky high fuel price hits Nepal’s tourism, airlines

One month after Russia’s invasion of Ukraine, the fallout of the war on global fuel prices threatens to derail Nepal’s aviation and tourism sector which was finally reviving after two years of the Covid pandemic.

Nepal Oil Corporation (NOC) has raised prices for petrol and diesel at filling stations several times, but it is aviation turbine fuel (ATF) that has seen the steepest hike.

International airlines serving Kathmandu which had already seen some booking cancellations due to the Ukraine war are now paying double the rate for refuelling their planes at Kathmandu airport.

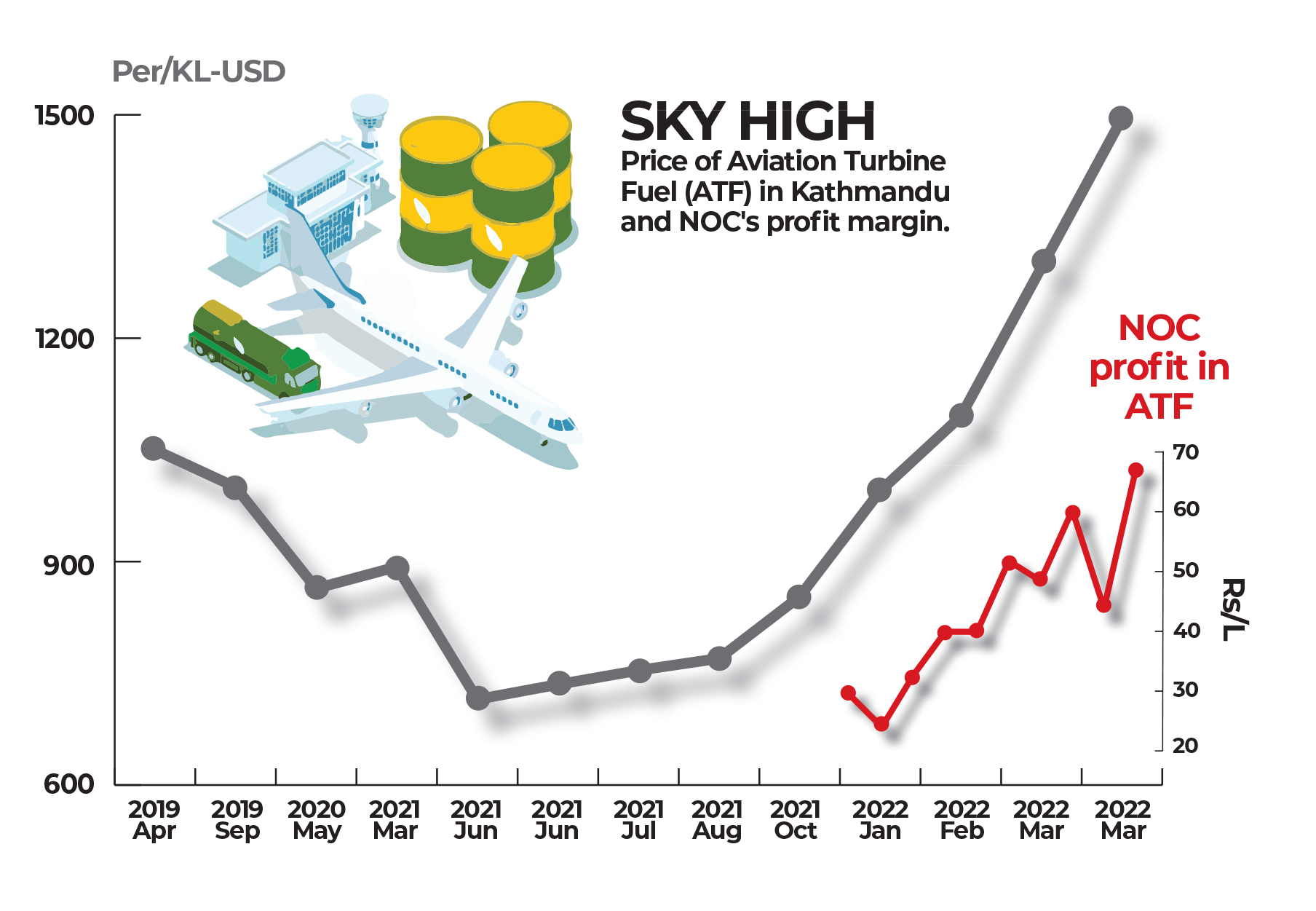

ATF cost in Kathmandu has risen steeply from $715 per kilolitre in June last year to nearly $1,500 after the latest NOC price hike on 17 March (see graph).

But the NOC appears to be passing on the rising import bill for petroleum products to its customers, while keeping its profit margins intact. The state-owned monopoly’s own website shows that the profit it makes from ATF sold to airlines has risen from Rs23.92 per litre inJanuary to Rs67.93 this week.

The NOC’s overall fortnightly losses have also soared from Rs1.83 billion to Rs4.66 in that same period. It is clear that NOC is compensating for its losses from petrol, diesel and LPG sales at fuel stations by doubling the price it charges airlines in order to subsidise Nepali customers.

NOC officials have justified the price hike saying that the fuel needs to be transported in tankers from the Indian border, and the hike in diesel prices has added to the cost of ATF in the international market.

However, the price of aviation fuel at Indian airports was only $900 per kilolitre — which is $600 less than in Kathmandu.

Nepal’s domestic airlines, which were seeing a boom since the Omicron wave started to subside earlier this year, have passed on the added cost to passengers with a hefty fuel surcharge.

However, it is medium and long haul operators to Kathmandu like Singapore Airlines, Korean Air, Turkish Airlines, Qatar Airways, Himalaya Airlines and Nepal Airlines which have been hit hardest. Airlines have started flying in on full tanks only topping up in Kathmandu to save on fuel costs.

Read also: Ukraine, Climate, and Nepal, Sonia Awale

A Boeing 777 or Airbus 330 on a 7-hour flight from Kathmandu to Incheon or Istanbul, for instance, burn 40 tons of fuel at a cost of $75,000. That cost will now soar, but airlines cannot raise prices on pre-booked tickets.

“Because of the rise in passenger demand we were thinking of increasing our frequency to daily flights, but with this kind of fuel cost it is just not feasible,” says one Kathmandu-based international airline executive. “Aviation fuel prices have gone up everywhere, but in Kathmandu it is 50-90% higher than any other Asian airport.”

NOC first raised its price of aviation fuel steeply to $1,095 on 2 March after the Russian invasion sent international oil prices sky high. It then raised it to $1,295 on 4 March, and again hiked it to $1,495 on 17 March.

Brent crude prices had dropped somewhat last week, but with Russian counter sanctions against oil and gas supplies to European countries and the spectre of a long-drawn war of attrition in Ukraine, it again climbed above the $120 per barrel mark.

Some US states have legislated to temporarily waive taxes on fuel to stabilise gas prices at filling stations and reduce burden on consumers. Nepal also has heavy taxes on all petroleum products, but it cannot afford to reduce the levee at a time when it faces budgetary pressures, a spiralling trade deficit, and plummeting foreign exchange reserves.

To be sure, Nepal is not alone in being hit by volatile oil prices because of Russia’s invasion of Ukraine, and the entire economy is affected — not just the aviation sector. However it could not have come at a worse time, just as the country’s tourism was starting to show signs of revival after two years of Covid closure.

Several European tour operators have cancelled bookings to Nepal at the last moment. The crisis has coincided with the start of the peak trekking and mountaineering season, and a large Ukrainian expedition to Mt Everest has been cancelled. The number of climbers who had booked Himalayan peaks is expected to go down by half.

More than 1 million people depend directly on Nepal’s tourism industry and they have been without income for more than two years because of the pandemic. There was considerable optimism that Spring 2022 would see a revival, but those hopes have been dashed.

There have been other indirect impacts from rising energy prices in Nepal, with electricity rationing this week along industrial corridors in the Tarai. As the dry season flow of Himalayan rivers reduces generation capacity, demand this week outstripped supply by 600MW.

The Nepal Electricity Authority (NEA) was meeting this shortfall with imports from the Indian grid, but on Tuesday and Wednesday it was outbid by other purchasers. Most of India’s electricity is generated from coal and diesel powered plants, and this has nearly doubled the price of peak power imports from India to INR13 per unit on Wednesday.

Read also: What does ‘Defending Europe’ mean?, Slavoj Žižek